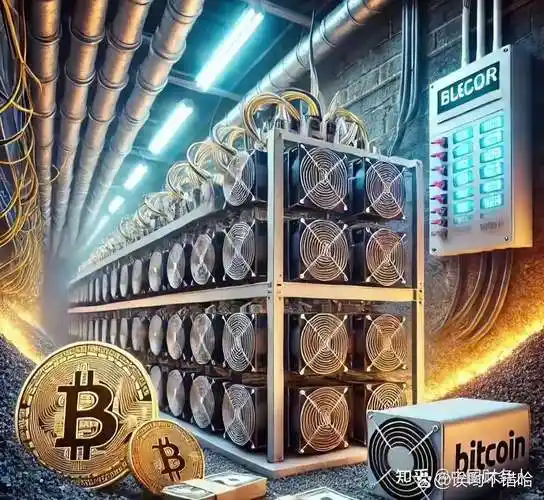

In the volatile world of cryptocurrency, the quest for maximizing returns is a never-ending saga, particularly for those deeply entrenched in mining. Among various coins vying for dominance, Kaspa has emerged as a compelling contender, spurred on by its innovative blockDAG protocol and impressive transaction speeds. Yet, the hardware you choose to deploy for mining — the beating heart of your operations — can undeniably tip the scale between profit and loss. Top-rated Kaspa mining rigs are engineered to steadfastly navigate the oscillations of market trends, allowing miners not only to stay afloat but to thrive amid ebb and flow.

The first step in maximizing returns lies in understanding the synergy between your Kaspa mining hardware and prevailing market dynamics. Kaspa, akin to Bitcoin (BTC), relies heavily on computational power, but with a distinct twist that influences how miners strategize. Unlike Bitcoin’s proof-of-work (PoW) consensus that hinges on a linear blockchain, Kaspa’s blockDAG allows for parallel block creation, effectively increasing throughput and minimizing latency. This architectural innovation beckons mining rigs capable of rapid processing with minimal energy consumption. Hence, investing in machines with optimized hashing power and energy efficiency, especially those tailored specifically for Kaspa, unlocks higher yield margins as electricity costs and hardware wear become more manageable variables.

Mining machine hosting services further augment profitability by offloading the operational burdens weighing on miners. Hosting providers offer turnkey solutions—from cooling infrastructure to uninterrupted power supply—allowing miners to focus on strategic asset management instead of the nitty-gritty of hardware upkeep. In a market where BTC, ETH, and emerging coins like Kaspa experience relentless competition amidst fluctuating exchange rates, minimizing downtime through hosting effectively amplifies uptime and by extension, revenue streams. Importantly, as cryptocurrency exchanges experience heightened volatility, maintaining continuous mining operations ensures you capitalize on opportunistic spikes without the risk of hardware shutoff during critical phases.

Diversification across multiple cryptocurrencies remains a sound approach, particularly since trends can pivot swiftly. Consider, for instance, the performance disparities between Bitcoin and Ethereum (ETH) markets, or more niche coins like Dogecoin (DOG). Miners wielding flexible hardware setups, designed to pivot between coin algorithms, harness a tactical advantage. Kaspa rigs that support multi-algorithm switching enable operators to dynamically allocate resources, mining whichever currency demonstrates peak profitability in real time. This elasticity is crucial during bear runs or bull cycles, dictating whether miners pursue long-term holdings or immediate liquidation tactics on various exchanges.

Moreover, the interplay between mining rewards and cryptocurrency exchange liquidity cannot be overstated. For miners entrenched in Kaspa, real-time exchange analytics inform strategic decisions on when to hold, sell, or swap mined coins. Robust hardware paired with insightful data empowers them to navigate sudden slumps or rallies effectively. Hosting platforms often bundle analytic tools with mining interfaces, imbuing users with real-time dashboard visualizations of hash rates, electrical consumption, coin yields, and price feed integrations from major exchanges. Such holistic ecosystems translate raw power into actionable intelligence, augmenting ROI quite dramatically.

Sector professionals also emphasize the critical importance of hardware lifecycle management. Mining rigs, whether dedicated to BTC, ETH, or Kaspa, face incessant computational stress. Over time, thermals fluctuate, component wear accelerates, and firmware demands upgrades to stay compatible with evolving protocols. Investing in top-tier Kaspa mining machines means not only embracing cutting-edge GPUs or ASIC miners with superior hash outputs but also prioritizing modular designs that ease maintenance and upgrades. This strategy prolongs machine viability, curbs unplanned expenses, and maintains consistent production, all fundamental ingredients for sustained profitability.

To this end, pooling resources through mining cooperatives or cloud-mining constructs continues to gain traction. These models decentralize entry barriers, enabling enthusiasts and professional miners alike to access premium Kaspa hardware via hosted services without hefty upfront capital. Such arrangements typically extract fees based on mined volume or uptime percentages but offset personal operational risks heavily. When aligned with market trend analyses, cloud-hosted Kaspa mining projects act as powerful engines of wealth generation, democratizing opportunities that once hinged solely on deep pockets and technical proficiency.

In conclusion, maximizing returns with top-rated Kaspa hardware in today’s unpredictable crypto market demands a blend of savvy hardware selection, strategic hosting partnerships, and agile market responsiveness. Kaspa’s innovative blockchain protocol rewards miners who prioritize performance efficiency and machine longevity. Pairing these qualities with diversified mining tactics and real-time exchange interactions enhances agility, scales operational throughput, and ultimately, ensures your mining venture outpaces market tumults. Whether individually or through cloud-based cooperatives, unlocking the full potential of Kaspa mining machines puts you at the forefront of crypto profitability, ready to harness the relentless waves of the digital asset revolution.

Leave a Reply