Entering 2025, the cryptocurrency landscape continues to evolve with unprecedented speed, making mining machine investments more critical than ever. Moving beyond mere basics means embracing a sophisticated understanding of mining rigs’ multifaceted roles in securing networks, generating profits, and sustaining blockchain ecosystems. This isn’t just about plugging in hardware and waiting—it’s a strategic dance involving market analysis, energy considerations, and technological foresight.

At the heart of this endeavor lies the mining machine itself—an intricate assembly of silicon and software engineered to solve complex cryptographic puzzles. The efficiency of these machines fluctuates widely, influenced by their hash rates and power consumption ratios. Enthusiasts often find themselves caught in a whirlwind of decisions: should one invest in cutting-edge ASICs designed primarily for Bitcoin, or opt for versatile GPUs capable of mining Ethereum and emerging altcoins? Each choice comes with its calculus of potential returns and operational intricacies.

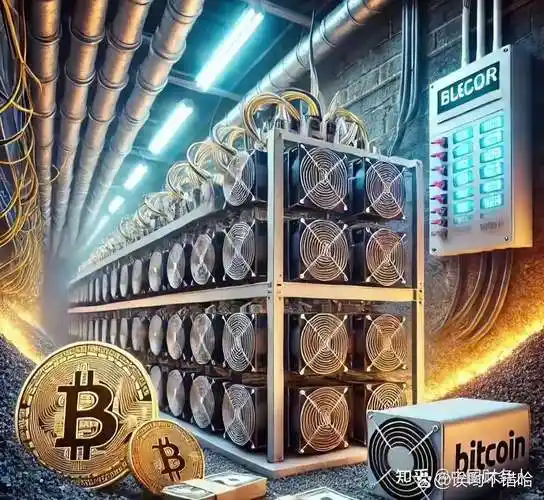

But mastering mining machine investments demands more than hardware prowess. Hosting solutions have become a game-changer, especially for investors seeking scalability without logistical headaches. Mining farm operators provide specialized environments optimized for temperature regulation, stable power delivery, and uninterrupted internet connectivity—elements indispensable for maximizing uptime and profitability. For those wary of fluctuations in electricity costs, these hosting farms often negotiate bulk energy contracts, buffering clients from volatile price swings.

Delve deeper, and one realizes that mining machine investments are inextricably linked to broader ecosystem dynamics. Take Bitcoin (BTC), for example: the network’s mining difficulty adjusts approximately every two weeks, reflecting the total computational power committed to securing transactions. A savvy investor should anticipate these adjustments, aligning acquisitions with forecasted difficulty trends to avoid diminishing returns. Similarly, Ethereum’s transition toward proof-of-stake introduces new layers of complexity; miners must track protocol updates and potential shifts in asset valuation.

Moreover, diversification emerges as a powerful strategy. Allocating capital across assets—BTC, ETH, and perhaps niche altcoins—can optimize risk-return profiles. Some altcoins may offer lower entry barriers for mining machines, albeit with heightened volatility. Yet, the upside can be substantial when these projects gain traction or integrate novel technologies. Staying agile is paramount; monitoring market sentiment, regulatory changes, and technological breakthroughs can inform timely pivots.

Consider energy consumption—a factor bearing heavily on profitability and environmental impact. Renewable energy sources increasingly power mining operations, aligning financial interests with sustainable practices. Forward-thinking investors not only reduce operational costs but also enhance corporate responsibility credentials, appealing to socially conscious stakeholders. The fusion of green energy and mining technology could redefine the industry’s narrative in 2025 and beyond.

Furthermore, the convergence of hardware innovation and artificial intelligence ushers in smarter mining management. Machine learning algorithms optimize performance by dynamically adjusting operational parameters, predicting hardware failures, and managing energy distribution. This technological synergy translates to higher uptime and reduced maintenance costs—a compelling proposition for anyone leasing or purchasing mining rigs.

In addition to technical and environmental considerations, the legal landscape demands attention. Regulatory frameworks worldwide continue to evolve, sometimes imposing constraints on mining activities or incentivizing clean energy adoption. Proactive compliance and legal analysis can avert costly disruptions, ensuring that investments remain shielded from adverse policies. Engaging with industry associations and staying abreast of governmental initiatives proves invaluable.

Ultimately, mastering mining machine investments transcends transactional thinking—it’s embracing an ecosystem where technology, market forces, energy economics, and regulation intersect. For 2025, success will favor those who harness data-driven insights, foster partnerships with reliable hosting providers, and anticipate the crypto space’s inevitable transformations.

Whether you are a seasoned miner or an emerging investor, the path forward is rich with opportunities and challenges. Mining machines remain the backbone of decentralized finance, and mastering their investment is key to surfacing lasting growth amidst the crypto tides.

Leave a Reply